-

EU countries reject move to weaken Deforestation Regulation

20 November 2024 -

Sustainable debt round-up: National Bank of Greece, California Community Choice, CTP ... and more

20 November 2024 -

BNP Paribas targets $500m for developed markets forestry fund

20 November 2024 -

La Banque Postale invests in ESG data startup

20 November 2024 -

Finance Earth plans for life after Federated Hermes following withdrawal from collabs

19 November 2024 -

EU supervisors estimate trillions in losses from 'run on brown' assets

19 November 2024 -

France launches voluntary biodiversity credit market

18 November 2024 -

EU countries failing to transpose CSRD risk increasing costs of compliance, observers say

18 November 2024 -

US and BTG Pactual launch $10bn Brazilian restoration coalition

18 November 2024 -

UK 'exploring value of' taxonomy after repeated delays

15 November 2024 -

UK government launches carbon and nature credit market principles

15 November 2024 -

'Very encouraging' European 'light green' fund investment in Middle East

15 November 2024 -

UK confirms plans to join EU in regulating ESG ratings providers

15 November 2024 -

People moves, 15 November: BlackRock, Barclays, South Pole, WHEB ... and more

15 November 2024 -

COP29: €3bn public-private fundraise planned for emerging market green bond fund

15 November 2024 -

New REDD+ methodologies approved by Integrity Council

15 November 2024 -

COP29: Investors underwhelmed by Global South investable pipeline

14 November 2024 -

COP29: Drafted 33-page NCQG text 'disappointing', says WWF

14 November 2024 -

COP29: Doubts remain over biodiversity credit market, says German minister

14 November 2024 -

COP29: 1.5°C slipping away without mandatory transition plans, says Guterres

14 November 2024 -

IOSCO encourages regulators to clarify issuers' liability for transition plans

14 November 2024 -

Iceberg Data Lab launches deforestation tool

14 November 2024 -

Investors urge EU against delaying deforestation regulation

13 November 2024 -

Buyers willing to pay 'much higher' prices for Article 6-aligned credits, says IETA

13 November 2024

- COP29: Financing Net Zero

- France launches voluntary biodiversity credit market

- Artesian: Two-way coupons could 'reignite' SLB market

- UK confirms plans to join EU in regulating ESG ratings providers

- COP29: a step Baku-wards?

- Finance Earth plans for life after Federated Hermes following withdrawal from collabs

- EU countries failing to transpose CSRD risk increasing costs of compliance, observers say

- Converting Bridgerton to Bog Hall

- UK 'exploring value of' taxonomy after repeated delays

- La Banque Postale invests in ESG data startup

-

20 November 2024

Investors 'sailing in the dark' on seafood supply chains, says Planet Tracker

Investors are "sailing in the dark" due to patchy data on seafood supply chains, Planet Tracker has warned, as it expands its open-source seafood database.

-

20 November 2024

Finance 'mission' launched to turbocharge investment in renewables, energy efficiency

-

20 November 2024

IFRS unveils guide to materiality assessment for sustainability reports

-

20 November 2024

COP29: Governments urge more finance for food systems decarbonisation

-

19 November 2024

Baillie Gifford pulls out of CA100+ and NZAM

-

19 November 2024

G20 leaders back country 'platforms' to boost private finance, urge NCQG progress

-

19 November 2024

COP29: Accounting association pushes countries to adopt ISSB standards

-

19 November 2024

Finnish FSA flags shortcomings in sustainability reports

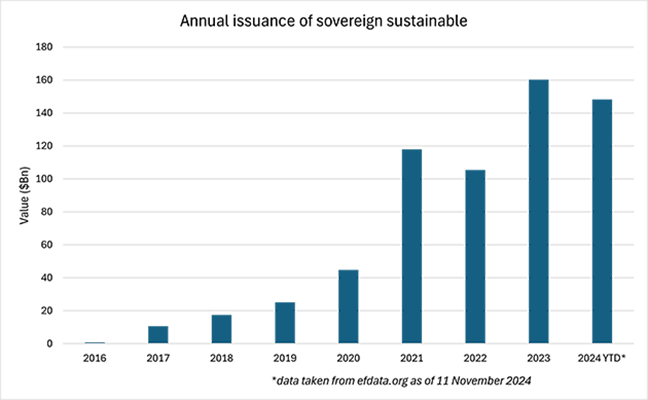

Annual issuance of sovereign sustainable

The sovereign sustainable bond market has seen significant growth since Poland issued the first sovereign green bond in 2016. The market grew steadily until 2021 when the sovereign and supranational-led response to covid resulted in a surge of issuance exceeding $117 billion. After cooling down in 2022 the sovereign sustainable bond market reached new all time highs in 2023 topping $160 billion in annual issuance. 2024 has been a strong year for sovereigns so far, with issuance currently at $148 billion there is opportunity for another record-breaking year.

For comprehensive data on all green, social, sustainability and sustainability-linked bonds and loans, please visit EF Data. For more information, a demo or a free trial please contact scott.davis@fieldgibsonmedia.com