-

People Moves, 12 September: TPG Rise Climate, BlackRock, Westpac NZ, ISF ... and more

12 September 2025 -

Robeco launches ASCOR-powered euro sovereign bond fund

12 September 2025 -

Norges Bank excludes French mining company

12 September 2025 -

Long-term climate risk blind spot leads OSFI to plan tests of financial firm models

12 September 2025 -

Dutch central bank to assess pension nature, climate risk

12 September 2025 -

IDB planning landmark 'Amazonia Bond' debut in 2026

11 September 2025 -

Australian super fund backs Macquarie as part of AUD2bn impact allocation

11 September 2025 -

SEC chair says 'concerning' EU sustainability rules should dump double materiality

11 September 2025 -

Finance a key theme for COP30, says CISL

11 September 2025 -

UK unveils legislation to ratify High Seas Treaty

11 September 2025 -

IFC plans $250m green, blue bond investment in Bank Pekao

11 September 2025 -

US regulator withdraws carbon credits guidance months after it was introduced

11 September 2025 -

RepRisk: Huge potential for geospatial technology to drive risk management

11 September 2025 -

NIB launches 'Sustainability-Linked Loan Bond' framework

11 September 2025 -

UK focus on place-based impact will change schemes' fund manager relationships

11 September 2025 -

China's transition taxonomy pilot gaining momentum, says Ma Jun

11 September 2025 -

European equity funds resort to 'brownwashing' as ESMA deadline hits, says Morningstar

10 September 2025 -

Sustainable debt round-up: Saudi Awwal, San Francisco BART, Endeavour Energy ... and more

10 September 2025 -

Sobha Realty raises $750m from debut green sukuk

10 September 2025 -

Join NBIM, GSAM and the FCA at The Future of ESG Data conference

10 September 2025 -

Industry must tackle structural barriers facing nature-based solutions, report finds

10 September 2025 -

Von der Leyen pledges EU cleantech financing as she lauds Omnibus in landmark speech

10 September 2025 -

BNPP Future Forest Fund makes first two investments

10 September 2025 -

Environmental Finance Sustainable Company Awards 2025 winners announced

10 September 2025

-

FAB raises $750m from nuclear-focused 'low-carbon energy' bond

10 September 2025 -

European regs are chaotic and desperately need simplifying, says Allianz

09 September 2025 -

TVO issues 'first-of-a-kind' nuclear power 'European Green Bond'

09 September 2025 -

Make international transition finance work more coherent, Japanese bank urges

09 September 2025

- TVO issues 'first-of-a-kind' nuclear power 'European Green Bond'

- Environmental Finance Sustainable Company Awards 2025 winners announced

- Sustainability labels - putting biodiversity on a shelf

- Join NBIM, GSAM and the FCA at The Future of ESG Data conference

- FAB raises $750m from nuclear-focused 'low-carbon energy' bond

- Sustainability thought leader of the year: Namita Vikas, auctusESG Global

- Von der Leyen pledges EU cleantech financing as she lauds Omnibus in landmark speech

- RepRisk: Huge potential for geospatial technology to drive risk management

- European equity funds resort to 'brownwashing' as ESMA deadline hits, says Morningstar

- Sustainable debt round-up: Saudi Awwal, San Francisco BART, Endeavour Energy ... and more

-

12 September 2025

EU's judiciary rejects complaint at nuclear and gas in taxonomy

-

11 September 2025

European supervisors call for shortened PAI rules after finding improved reports

-

11 September 2025

Belgian meat processers pitch SME reporting template to 'replace EFRAG tool'

-

11 September 2025

'New era' hailed for emissions accounting with ISO, GHG Protocol tie-up

-

11 September 2025

KawiSafi raises $90m for second Africa clean energy blended finance fund

-

11 September 2025

RGreen provides €50m debt to SWEN-backed biomethane producer

-

11 September 2025

SUSI divests 80% of second renewables fund with latest exit

-

10 September 2025

EIG, National Wealth Fund back £1bn investment in UK's 'largest' BESS project

Have you registered?

The conference starts on 18 September 2025 at 8:30AM ET.

ESG Data Guide 2025

Access data products though Environmental Finance’s unique directory. Sort by environmental, social, governance, indices/exchange, verification/certification data or rankings or ratings.

Click here to view the guide

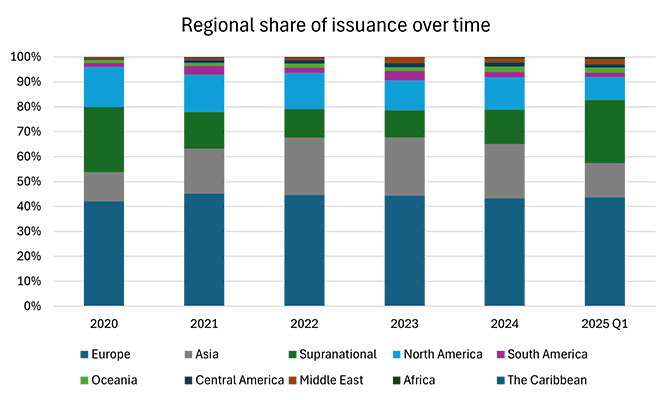

Regional share of issuance over time

The past five years have seen the regional making of sustainable bond issuance shift in the face of global dynamics. In 2020 supranational issuance surged in response to the Covid-19 pandemic, yet receded as Asian issuance grew and European issuance dominated while North American issuance fluctuated between 2020 and 2025.

However Q1 2025 has seen a large drop off in the share of both North American and Asian issuance in the face of economic uncertainty, and in the US particularly – political backlash to sustainable financing. Conversely the share of supranational issuance has returned to similar levels as in 2020, with a quarter of the market compared to 26% in 2020. Meanwhile Middle Eastern issuance, which accounted for only 0.66% of the sustainable bond market in 2020 now accounts for 2.2% in the first quarter of 2025.

For comprehensive data on all green, social, sustainability and sustainability-linked bonds and loans, please visit EF Data. For more information, a demo or a free trial please contact scott.davis@fieldgibsonmedia.com