-

Rathbones adopts SDR label for two funds days before FCA's deadline

31 March 2025 -

EU issues 'urgent' request for advice on CSRD cutbacks

31 March 2025 -

Meta, Climate Asset Management secure million-tonne forest carbon deal

31 March 2025 -

Indian muni issuers still 'missing green bond potential'

28 March 2025 -

Axa IM 'downgrades' and 'may reduce exposure to' companies that weakened climate targets

28 March 2025 -

SEC ends defence of climate rule in 'backward step for investors'

28 March 2025 -

TotalEnergies to generate 50 million nature-based credits

28 March 2025 -

People Moves, 28 March: Phoenix Group, Capricorn, Rebalance Earth ... and more

28 March 2025 -

Redemptions, taxonomies to help sustainable bond market to fresh highs, says SocGen

27 March 2025 -

Cambridge Associates shifts sustainability focus to climate risk planning

27 March 2025 -

Canadian election 'casts a shadow over' work on taxonomy, disclosures

27 March 2025 -

Biodiversity data tool map finds key imbalances

27 March 2025 -

'Momentum returning' to SLL market but targets and transition plans must improve, webinar hears

27 March 2025 -

UK government releases 'world-leading' nature finance standards

27 March 2025 -

Sustainable Debt EMEA returns to London next week

27 March 2025 -

Philip Lee expands into US amid expected carbon removal boom

27 March 2025 -

Taxonomy cuts to 'significantly damage' sustainable investment market, warn EU advisers

26 March 2025 -

Sustainable debt round-up: IBRD, SEB, Stack Infrastructure ... and more

26 March 2025 -

Golding closes debut impact fund of PE funds shy of target

26 March 2025 -

Trade associations launch 'refreshed' sustainable loan principles

26 March 2025 -

UK government recommits to BNG

26 March 2025 -

National Wealth Fund must bridge UK transition financing gap, says Phoenix

26 March 2025 -

Reliance on taxonomy would be ill-advised in overhauled SFDR, ICMA tells EU

25 March 2025 -

Canada, Japan targeted in PRI sovereign engagement initiative expansion

25 March 2025 -

Australia makes investment to help kickstart nature credit market

25 March 2025 -

More EM sovereign SLBs 'can be done' as early potential emerges, says Ninety One

25 March 2025 -

Kommuninvest launches social bond debut after 'rapid' lending growth

24 March 2025

- Axa IM 'downgrades' and 'may reduce exposure to' companies that weakened climate targets

- Blended finance in fragile contexts: Ukraine as a test case

- Redemptions, taxonomies to help sustainable bond market to fresh highs, says SocGen

- TotalEnergies to generate 50 million nature-based credits

- Indian muni issuers still 'missing green bond potential'

- Sustainable Bonds Insight 2025

- 'World first' carbon credit standard launched

- Cambridge Associates shifts sustainability focus to climate risk planning

- EU countries agree to 'stop the clock' on CSRD reporting

- Persefoni to launch carbon footprinting tool after raising $23m

-

31 March 2025

Australian regulator issues sustainability reporting guidance

-

31 March 2025

Newcore raises £100m social infra fund

-

31 March 2025

Innovative parametric insurance product helps protect against flooding in Togo

-

28 March 2025

Persefoni to launch carbon footprinting tool after raising $23m

-

27 March 2025

Triodos Bank makes nature loan to RESTORE

-

27 March 2025

TPG Rise Climate starts deploying €2.5bn Global South strategy

-

27 March 2025

CIP backs Italian battery storage portfolio

-

27 March 2025

Schroders Greencoat acquires 49% of €580m Spanish renewables portfolio

Have you registered?

The conference starts on 3 April 2025 at 8:30AM BST.

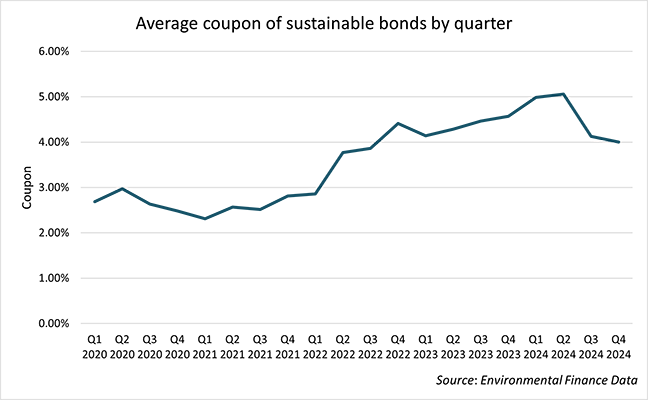

Average coupon of sustainable bonds by quarter

2024 was a story of two halves for sustainable bond coupon rates. The first half of the year saw coupons edge up to an average of 5.06% in Q2 - the highest they have been during five year period looked at in the below chart. After the second quarter there was a sharp decline in average coupon rates to 4.13% in Q3, falling further to 4% in Q4. Even with the decline in the second half of the year, average coupons for full year 2024 were the highest they have been over this five-year period.

For comprehensive data on all green, social, sustainability and sustainability-linked bonds and loans, please visit EF Data. For more information, a demo or a free trial please contact scott.davis@fieldgibsonmedia.com